Did You Know That Your Company's Health Insurance Might Not Be Enough?

Many employees assume that their company-provided health insurance is sufficient to cover any medical emergencies they might face. However, the reality is that the annual limit allocated under most corporate medical insurance plans may not be enough, especially in cases involving severe illnesses or accidents requiring expensive treatments. If your medical bills exceed the limit set by your employer’s insurance, you will have to bear the remaining costs out of pocket.

The Limitations of Company Health Insurance

Most corporate health insurance plans come with a predefined annual limit. While this may seem adequate for general medical needs, it might not be sufficient for major medical treatments. For instance, a company may provide an annual medical limit of RM50,000, which might not be sufficient to cover for critical conditions such as accident requiring implants, cancer treatments, or heart-related surgeries. Medical costs can easily surpass this limit. In such situations, employees are left with significant financial burdens.

How a Top-Up Medical Plan Can Help

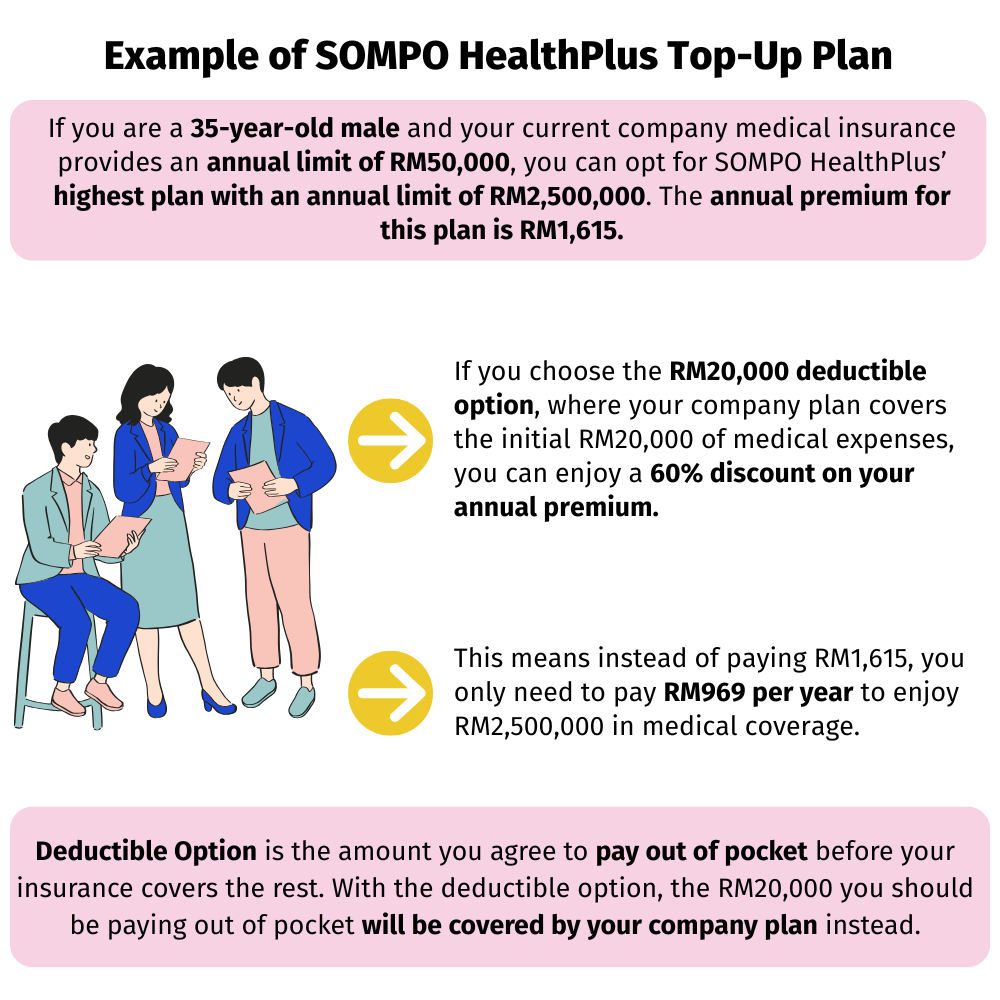

This is where a top-up medical insurance plan comes in handy. A top-up plan allows you to enhance your existing corporate medical insurance, giving you a much higher annual limit without having to purchase a separate full-coverage plan.

SOMPO HealthPlus offers a top-up medical insurance plan that enables policyholders with existing company medical insurance to enjoy an increased annual limit. By complementing your company-provided insurance, you can significantly reduce the risk of paying out-of-pocket expenses for high-cost treatments.

Secure Your Future With Enhanced Coverage

Medical expenses are rising every year due to inflation and advancements in medical treatments. Relying solely on your company’s health insurance might not be enough when faced with unexpected medical costs. By investing in a top-up plan like SOMPO HealthPlus, you ensure better financial protection and access to the best medical treatments without worrying about exceeding your company insurance limit.

Protect yourself and your loved ones today. Consider a top-up plan to ensure peace of mind and comprehensive healthcare coverage.

Get protected with our Health Insurance today!

Explore our top two plans, designed to fully cover kidney dialysis expenses while also providing comprehensive protection for cancer, heart treatments, and more.