Designed for Flexibility

Choose from 2 Comprehensive Plans for convenience or Opt for the Flexibility to choose what matters most to your business

We understand that running an SME business in Malaysia is a challenge. You have poured in much sweats and tears, fueled by courage and passion, towards a successful business. Coupled with the ever-changing business landscape, there are many obstacles to overcome. At the same time, even though SMEs are smaller in size, it doesn’t mean that you are not expected to meet the same standards as larger businesses, from staff welfare to risk management and compliance.

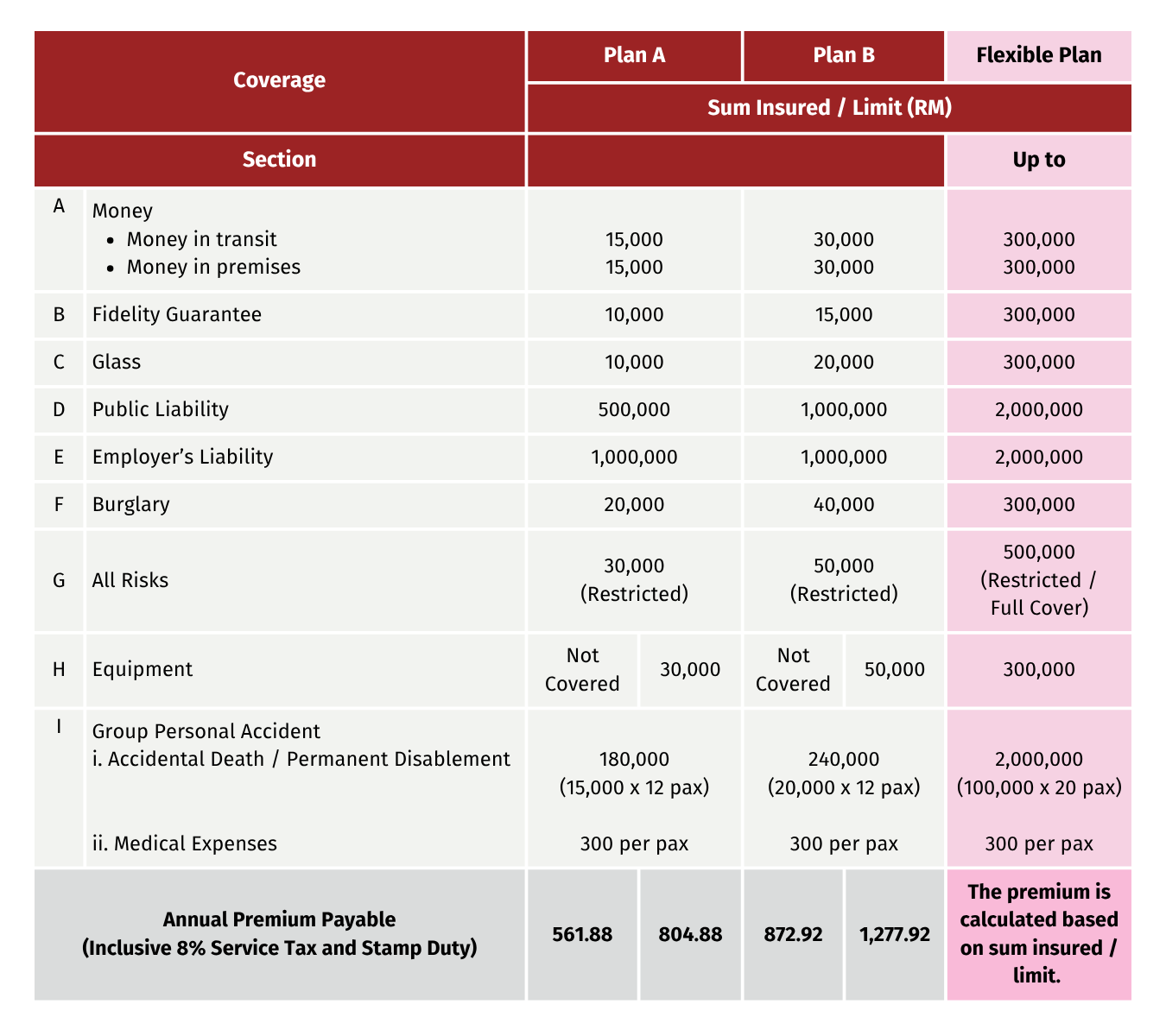

With limited time and resources, many SME owners face the daunting task of managing their financial risks when it comes to unexpected losses. This is why having a comprehensive insurance plan will take much of your burdens of your shoulders. We have carefully designed a solution which provides you with coverage of 9 essential areas, providing your business with the protection that it needs.

Specially designed for Berjaya Sompo Insurance SOMPO Fire or Fire policyholders

- Packaged coverage, less hassle - Choose from 3 plan options with 9 coverage classes

- Option to customise coverages depending on your business needs

- Cater to various SME businesses to meet different industry needs

- Quick and seamless enrolment with simple onboarding process

Plans

- All sections (except H - Equipment) are compulsory for Plan A and B, whereas minimum two (2) sections must be selected for Flexible Plan.

- The benefit(s) payable under eligible Policy is (are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Berjaya Sompo Insurance Berhad or PIDM (visit www.pidm.gov.my)

- Please refer to the Policy Contract for full details of the benefits and coverage.

Additional Information

Frequently Asked Questions

Is there a need to purchase a Fire Policy?

Yes, as the package does not have a Fire Section. You would need to purchase a Fire policy from Berjaya Sompo Insurance to be eligible to purchase SOMPO FlexiSME.What is the Period of Cover and Renewal Option?

Duration of cover is for one (1) year. You need to renew the Policy annually.How much premium do I need to pay?

This is an annual Policy. The premium charges are based on the section/plan chosen by you.How many classes of insurance do I need to choose from the types of coverages?

All sections (except H - Equipment) are compulsory for Plan A and B, whereas minimum two (2) sections must be selected for Flexi Plan.What is the premium and excess imposed in this Policy?

The premium and excess will be quoted on a case-by-case basis. You may contact our branch office or Customer Service Centre for further information.- Where can I get further information?

You may contact our branch office or Customer Service Centre at 03-2170 7300 during the operating hours from 8.30am to 5.00pm (Monday – Friday) or call our Toll Free number at 1-800-889-933.

Major Exclusions

This Policy does not cover :-

• Nuclear Energy Risks Exclusion Clause

• Property Cyber and Data Exclusion

• War and Terrorism Exclusion

Note: This list is non-exhaustive. Please refer to the Policy Contract for the full list of exclusions.

Downloads

Please be informed that we will never ask you to provide your personal details online in order to access any product information available on our corporate website. We urge all customers to remain vigilant against online scams.