Travel Smart: Why Business and Frequent Travellers Need Annual Travel Insurance?

In today’s fast-paced world, where business deals are often sealed across continents and spontaneous getaways have become the norm, travel has become an integral part of many lifestyles. For business professionals and frequent travellers, hopping on a plane or packing a suitcase can feel like second nature. However, amidst the excitement of travel lies the unpredictability of unforeseen events. This is where an annual travel insurance plan becomes not just a wise choice but a lifestyle essential. Here’s why every business and frequent traveller should consider investing in this vital coverage.

Multiple Trips, One Policy. Embracing the Travel Lifestyle.

Travelling often brings new opportunities, whether it’s closing a deal in a bustling city, attending a conference, or exploring new cultures during a weekend getaway. But with these adventures come inherent risks, from flight cancellations to medical emergencies. An annual travel insurance plan acts as a safety net, allowing you to travel confidently without worrying about what could go wrong.

Who Benefits from Annual Travel Insurance?

A. Business Professionals: For those who frequently travel for work, an annual plan provides coverage for multiple trips throughout the year. Whether it’s attending meetings, conferences, or client visits, the last thing you want is to be left unprotected in the event of a mishap.

B. Frequent Leisure Travellers: If you find yourself taking several vacations each year, whether for relaxation or exploration, an annual travel insurance plan simplifies your travel experience. It means one less thing to think about before every trip, ensuring you’re protected wherever you go.

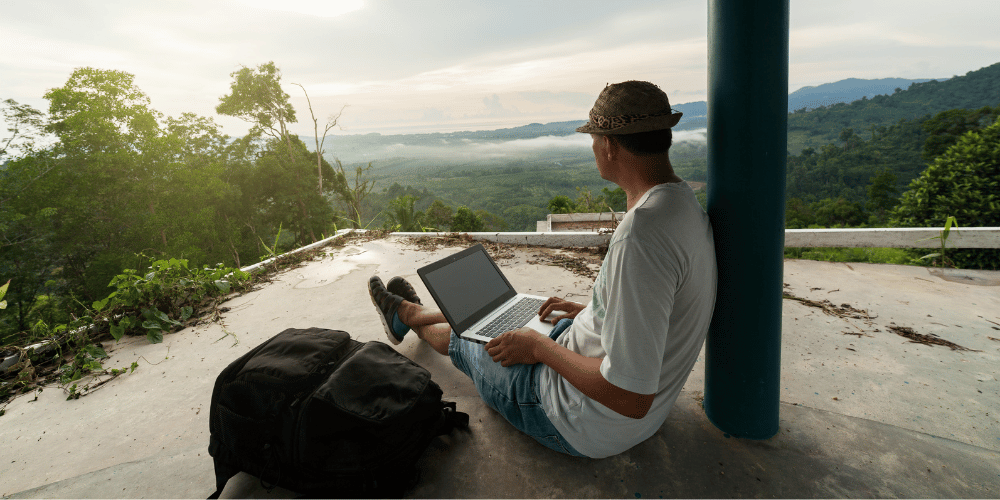

C. Remote Workers and Digital Nomads: The rise of remote work has led many to blend work with travel. For those who constantly shift locations, having a comprehensive insurance plan means peace of mind as you navigate new environments.

Why you should choose Annual Travel Insurance Plan?

Cost-Effectiveness:

Purchasing individual travel insurance for every trip can quickly become expensive. An annual plan typically offers a more economical option, covering multiple trips under one policy. This is especially beneficial for business travellers who may travel several times a month or a year.

Comprehensive Coverage:

Whether it’s lost luggage, trip cancellations, or medical emergencies, an annual travel insurance plan covers a wide range of scenarios. This means that no matter what challenges arise, you’re protected against potential financial losses.

Emergency Medical Protection:

When travelling abroad, accessing medical care can be daunting and costly. Most health insurance plans do not provide coverage outside your home country. An annual travel insurance plan often includes emergency medical coverage, ensuring you receive the necessary treatment without the burden of exorbitant costs.

Flexibility and Convenience:

With an annual plan, you don’t have to purchase new insurance for every trip. This flexibility is particularly beneficial for business travellers with fluctuating schedules. You can book a last-minute flight or extended stay without worrying about insurance coverage.

24/7 Support:

Many annual travel insurance plans offer around-the-clock assistance, which can be invaluable during emergencies. Whether you need help finding a doctor or rearranging travel plans, having access to expert support can alleviate stress and allow you to focus on what matters.

Protection Against Travel Disruptions:

From weather-related delays to natural disasters, travel disruptions can happen unexpectedly. An annual travel insurance plan can help cover additional expenses incurred due to these interruptions, giving you peace of mind when travel plans change.

Customisable Options:

Many insurers offer customisable plans tailored to your specific needs, whether you require coverage for business equipment, adventure activities, or pre-existing medical conditions.

Travel with Confidence

For business and frequent travellers, an annual travel insurance plan is more than just a precaution; it’s a lifestyle necessity. It allows you to embrace the joy of travel while minimising potential risks, so you can focus on building relationships, closing deals, and creating lasting memories.

As you prepare for your next journey, consider how an annual travel insurance plan can enhance your travel experience. By investing in comprehensive coverage, you can embark on your adventures with confidence, knowing that you are protected no matter where your travels take you. So, travel smart and ensure that your next trip is as enjoyable and worry-free as possible. Safe Travels!

Other good reads that you might be interested in:

- Navigating the Unthinkable: The Importance of Repatriation Coverage for Malaysians in Times of Grief

- Embracing Wanderlust: Seniors and Retirees Lead the Travel Boom

- The Unforgettable Adventure of Solo Travel: Unlocking the World, One Journey at a Time

- Family Travel: A Rollercoaster of Laughter and Chaos

- The Thrill of the Game: Traveling for Sports and Adrenaline-Fueled Experiences

- Discovering the Allure of Sabah: A Cultural Haven and Seafood Paradise

- Why Malaysians Should Choose Travel Insurance Over Airline Coverage?

Introducing SOMPO TravelSafe+

Be it a vacation or a business trip that you are planning, do not miss out on getting protected from COVID-19. We bring you SOMPO TravelSafe+, a comprehensive travel Policy that covers losses resulting from COVID-19 diagnosis and other unforeseen events during your travel.

Are you travelling soon? Get SOMPO TravelSafe+ and enjoy these 6 stunning benefits for the best travel experience!

Medical, Hospital & Other Expenses up to RM500,000 due to COVID-19

Emergency Medical Evacuation & Repatriation

Loss of Deposit or Cancellation due to COVID-19

Overseas Quarantine Allowance Due to COVID-19

Automatic Extension due to flight delay or if You are hospitalised