Ultima Care For Professionals

You're ambitious, independent, and striving for success. But have you thought about what happen if an accident derails your plans? With Ultima Care, you get financial security so you can focus on building your career without setbacks. Whether you're commuting, spending your time at home, or pursuing your passions, we’ve got your back.

What are the Professionals looking for in Ultima Care?

"I want peace of mind knowing that if something happens to me, my credit card debts will be taken care of so my family isn’t left struggling."

"If an accident damages my tooth and I need a replacement, I want coverage to help with the high costs—because dental work can be incredibly expensive."

"If I’m hospitalised due to an accident, I want to be compensated so I can focus on recovery without worrying about lost income or extra expenses."

"If the worst happens and I pass away, I want my parents to receive financial support to ease their burden during such a difficult time."

"I want a plan that covers not just medical bills but also rehabilitation costs, so I can get back on my feet without financial stress."

"I want guaranteed access to ambulance services without upfront payments, especially during emergencies."

Go Beyond The Essential and Maximise Your Protection

We offer tailored protection plans combining essential benefits with optional add-ons designed to meet the unique needs of professionals like you.

These benefits are carefully curated based on what our customers value most. They include essential coverage and optional add-ons, tailored to suit professionals like you. For the full list of 25 benefits under Ultima Care, please refer to the Policy Contract or reach out to us and we will be happy to connect you with our friendly agent.

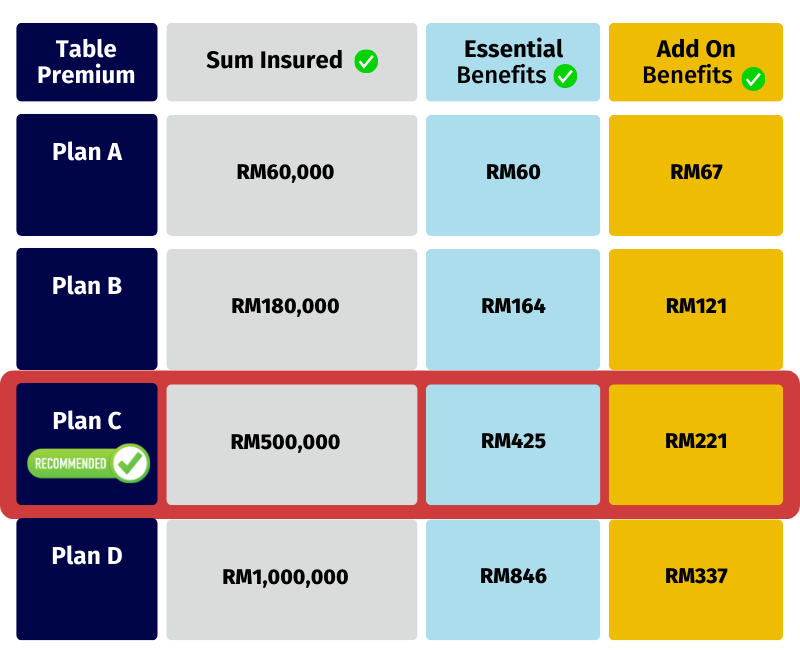

Enjoy all these awesome benefits with up to RM500,000* coverage from as low as RM1.77 a day!

The above premiums for Plan A, B, C, and D are the same as those for the current Plans 1, 3, 6, and 8 under the Ultima Care Personal Accident.

Premium shown above excludes RM10 Stamp Duty and 8% Service Tax

*Maximum payout applies to Death & Permanent Disablement (1st year only). Terms and conditions apply.

The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Berjaya Sompo Insurance Berhad or PIDM (visit www.pidm.gov.my)

Interested? Complete the form here and one of our agents will be in touch with you.

Frequently Asked Questions (FAQ)

What are other additional coverages in this recommended plan that are not listed above?

In this recommended plan, there are other additional coverages you will enjoy, such as:

- Medical Expenses

- Alternative Medical Treatment

- Dental Correction and/or Corrective Surgery

- Funeral Allowance

- Bereavement Allowance (Death due to Dengue Fever, Malaria or Japanese Encephalitis)

- Daily Hospital Visitation Allowance

- Major Burn

- Coma

- Prostheses / Wheelchair

- Kidnap Benefits

- Miscarriage due to motor vehicle

- Blood Contamination / Transfusion

- Permanent Impotency or Infertility

- Financial Protector

- Snatch Theft Compensation

For full details on the coverage offered by Ultima Care, please refer to the Policy Contract and Policy Wording.

Is there any lower premium plan I can purchase?

Yes, Ultima Care offers 8 different plans. For full details on what’s covered, please check refer to the Policy Contract and Policy Wording.

What occupational classifications are eligible for the recommended plan?

The recommended plan is only offered to the following classes of occupation:

Class 1:

Professions involving non-manual, administrative or clerical work, solely in offices or similar non-hazardous places. Example: Banker, Housewife, Retiree, Administrator, etc.

Class 2:

Professions involving mainly supervisory duties which may include occasional manual work with some occupational risk exposure or significant travelling outside office on business purposes. Example: Fitness Trainer, Beautician, Florist, Hairdresser etc.

What are the exclusions?

Pre-existing physical or mental defect or infirmity, suicide or attempted suicide, intentional self-injury, influence of alcohol or drug, AIDS/HIV, professional sports/activities, war, riot/strike etc.

Note: This list is non-exhaustive. Please refer to the Policy Wording for the full list of exclusions.