Ultima Care For Sophisticated Family

Your family is your world, and their security is non-negotiable. Ultima Care ensures that you and your loved ones are protected from life’s uncertainties, keeping your dreams for the future intact.

The Biggest Worries on Young Families’ Minds Today

"We have so many bills, mortgage, school fees, daily expenses. What if an accident adds to the burden?"

"If I’m hospitalised, how will we manage daily expenses without my income?"

"What if something happens to me? Who will take care of my children?"

"What if I become disabled, how will we survive financially?"

"I want to make sure my spouse isn’t left with debt if I’m gone"

"Medical bills are so expensive. How will we afford treatment if one of us gets hurt?"

A perfectly curated protection plan for your family because they deserve nothing less than the best!

These benefits are thoughtfully selected to align with what families value most. With essential coverage and optional add-ons, our plans are designed to provide peace of mind for you and your loved ones. For the full list of 25 benefits under Ultima Care, please refer to the Policy Contract or reach out to us and we will be happy to connect you with our friendly agent.

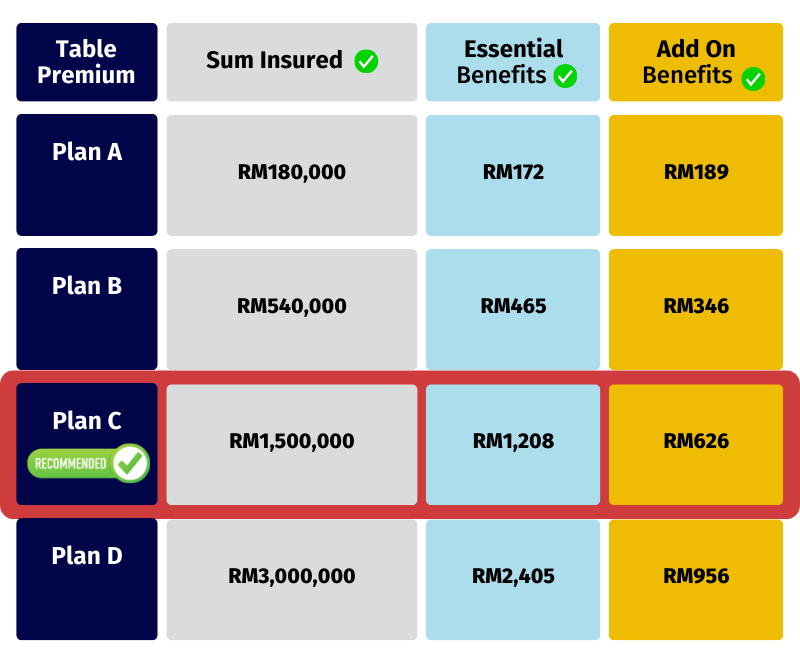

Enjoy all these stunning benefits with a maximum payout of up to RM1,500,000* from as low as RM5.02 per day with our recommended plan!

The above premiums for Plan A, B, C, and D are the same as those for the current Plans 1, 3, 6, and 8 under the Ultima Care Personal Accident.

Premium shown above excludes RM10 Stamp Duty and 8% Service Tax

*Maximum payout applies to Death & Permanent Disablement (1st year only). Terms and conditions apply.

The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Berjaya Sompo Insurance Berhad or PIDM (visit www.pidm.gov.my)

Interested? Complete the form here and one of our agents will be in touch with you.

Frequently Asked Questions (FAQ)

What are other additional coverages in this recommended plan that are not listed above?

In this recommended plan, there are other additional coverages you will enjoy, such as:

- Medical Expenses

- Alternative Medical Treatment

- Dental Correction and/or Corrective Surgery

- Funeral Allowance

- Bereavement Allowance (Death due to Dengue Fever, Malaria or Japanese Encephalitis)

- Daily Hospital Visitation Allowance

- Major Burn

- Coma

- Prostheses / Wheelchair

- Kidnap Benefits

- Miscarriage due to motor vehicle

- Blood Contamination / Transfusion

- Permanent Impotency or Infertility

- Financial Protector

- Snatch Theft Compensation

For full details on the coverage offered by Ultima Care, please refer to the Policy Contract and Policy Wording.

Is there any lower premium plans I can purchase?

Yes, Ultima Care offers 8 different plans. For full details on what’s covered, please check the Policy Contract and Policy Wording.

What occupational classifications are eligible for the recommended plan?

The recommended plan is only offered to the following classes of occupation:

Class 1:

Professions involving non-manual, administrative or clerical work, solely in offices or similar non-hazardous places. Example: Banker, Housewife, Retiree, Administrator, etc.

Class 2:

Professions involving mainly supervisory duties which may include occasional manual work with some occupational risk exposure or significant travelling outside office on business purposes. Example: Fitness Trainer, Beautician, Florist, Hairdresser etc.

What are the exclusions?

Pre-existing physical or mental defect or infirmity, suicide or attempted suicide, intentional self-injury, influence of alcohol or drug, AIDS/HIV, professional sports/activities, war, riot/strike etc.

Note: This list is non-exhaustive. Please refer to the Policy Wording for the full list of exclusions.