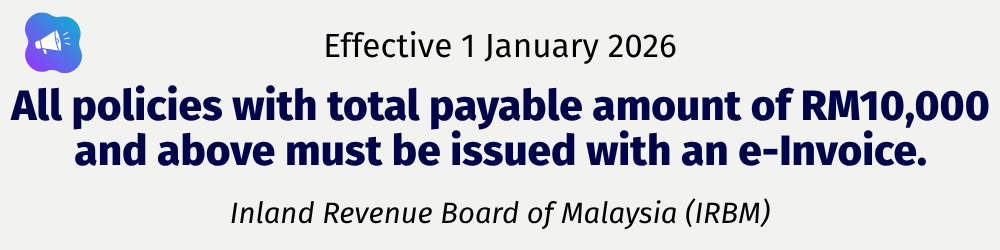

In addition to our earlier announcement on the full implementation of e-Invoicing effective 1 July 2025, please be informed that Inland Revenue Board of Malaysia (IRBM) has released a new guideline.

To ensure a smooth experience and avoid any disruptions in receiving your eInvoice, we kindly urge all clients to ensure their personal details such as Tax Identification Number (TIN), Sales and Service Tax (SST) number if applicable, phone number, email address, and other relevant information are accurate and up to date in our records.

To comply with this requirement, we kindly remind all policyholders and clients to:

- Provide a validated Tax Identification Number (TIN) (mandatory for policies ≥ RM10,000).

- Ensure that all other mandatory information (e.g. Business Registration/Identification Number, Contact number, Email address, Sales and Service Tax (SST) number if applicable) are accurate and up to date in our records. You may reach out to your Marketers or our Customer Service to update your information.

- If you have not registered for a TIN with IRBM, please do so promptly to avoid any disruptions in policy servicing or e-Invoice issuance.

This page provides answers to frequently asked questions (FAQs) about e-Invoicing, what it is, how it may affect you, and any actions you may need to take.

Malaysia e-Invoice Implementation FAQs

What is the difference between e-Invoice and the traditional invoice?

Unlike traditional invoices, e-Invoice must be submitted to IRBM for validation.

Who will receive the e-Invoice?

In accordance with IRBM guidelines, the e-Invoice will be issued to the policyholder.

When is the implementation date for policyholders to start receiving e-Invoices?

Insurance companies have been granted approval by IRBM to issue validated e-Invoices with QR codes to policyholders starting from 1 July 2025.

How can I get e-Invoice?

Your e-Invoice will be sent to the email address you have provided to us during your policy application or update.

What is the mandatory information required to receive e-Invoice?

For Malaysians:

- Name (as per NRIC)

- Tax Identification Number (‘TIN, with the prefix of 'IG’)

- NRIC Number

- Contact Number

- Email Address

- Mailing / Correspondence Address

For Non Malaysians:

- Name (as per passport)

- Tax Identification Number (‘TIN, with the prefix of 'IG'), if applicable

- Passport Number

- Contact Number

- Email Address

- Mailing / Correspondence Address

For Corporate Owners:

- Company Name (as per SSM)

- Tax Identification Number (‘TIN)

- New Business Registration Number (BRN)

- Sales and Service Tax (SST), where applicable

- Company Contact Number

- Company Email Address

- Company Address

For Sole Proprietorship:

- Name (as per in MyTax profile https://mytax.hasil.gov.my/)

- Tax Identification Number (‘TIN, as per in MyTax profile https://mytax.hasil.gov.my/)

- NRIC Number or New Business Registration Number (as per in MyTax profile https://mytax.hasil.gov.my/)

- Sales and Service Tax (SST), where applicable

- Contact Number

- Email Address

- Mailing / Company Address

How do I update my personal details?

You may contact us via:

Customer Service Hotline from 8:30am to 5:00pm (Monday to Friday; excluding Public Holidays)

- 1-800-88-9933 (Within Malaysia)

- +603-2170-7300 (Overseas)

- E-mail at customer@bsompo.com.my

- Facebook Messenger @berjayasompoinsurance

- Fill up Contact Us form on our website

- Download the MySOMPO app and signup to complete your profile with your Tax Identification Number (TIN)

What is a Tax Identification Number ('TIN')?

In Malaysia, both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia (IRBM) are assigned with a Tax Identification Number (TIN) known as “Nombor Pengenalan Cukai”.

TIN will be issued to all Malaysian citizens who attained the age of 18 years old and above.

Source: IRBM

Why do I need to update my Company Registration Number?

Effective 11 October 2019, the Companies Commission of Malaysia (SSM) adopted a new 12-digit registration number format for all companies, businesses, and Limited Liability Partnerships (LLPs).

To receive a validated e-Invoice, all SSM-registered businesses must provide their updated 12-digit registration number as required by IRBM.

Will the policyholders receive an e-Invoice if they do not provide their TIN?

e-Invoices may still be issued if the policyholder does not directly provide their TIN, as the insurer can retrieve it using IRBM’s TIN Search API. However, in certain cases, the TIN may not be found. To avoid delays or rejection of the e-Invoice, policyholders are strongly encouraged to provide their correct TIN.

Under what circumstances can the search for my TIN fail?

TIN search failures are governed by IRBM’s system. Common scenarios include:

- Multiple TINs registered under the same taxpayer.

- Taxpayers use an ID type not recognized or registered with IRBM, such as:

- Police ID

- Army ID

- Old SSM Number

- Mismatch of ID number/ ID type between BSIB’s record and MyTax profile – for example, a sole proprietor’s BSIB record uses a Business Registration Number, while his/ her MyTax profile is registered under NRIC.

What happen if I do not provide the required information for the issuance of e-Invoice?

If the information provided is incomplete or incorrect, the validation from IRBM will be fail and rejected, and the e-Invoice will not be issued to the policyholder.

What if I want to change the information in an e-Invoice?

Once an e-Invoice has been validated by IRBM, it cannot be revised or edited. Any changes would require cancellation of the original transaction and reissuance of a new one with the correct details.

Enjoy all these benefits by updating your profiles with us today!

Timely Reminders

Receive renewal reminders for uninterrupted insurance coverage

Claims Status

Stay informed about the status of your insurance claims

Promotions and Campaigns

Be the first to know about our promotions and campaigns

Policy Delivery and Payment

Experience swift policy delivery and payment

Seamless e-Invoicing Process

Receive e-Invoices launched by LHDN if you opt in

Environmentally Friendly

Going Paperless for more efficient and environmentally friendly future

For more information on e-Invoice, please visit IRBM website here.