Flood Assistance, Protection & Claims

With the increasing unpredictability of weather, the need for preparation has become more pressing to ensure we can offer ample assistance when it's most crucial. That’s why we’ve introduced S.H.I.E.L.D. It is your all-in-one resource for flood-related assistance, designed to provide you with the information necessary when a flood occurs.

What does SHIELD stand for?

We know it can be hard to think clearly during an emergency, so we’ve made flood preparedness easy to remember with SHIELD:

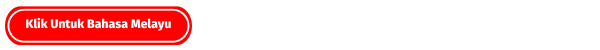

- S - Secure important documents in waterproof bags.

- H - Harness essentials in your emergency kit.

- I - Inform yourself about evacuation routes.

- E - Elevate valuables and electronics to higher ground.

- L - Listen to weather updates.

- D - Drive safely and avoid flooded areas.

Caught in a flood? Stay calm and focus on safety.

If you’re caught in a flood, stay calm and focus on safety. At home, turn off the main switch to avoid short circuits and move to higher ground if there’s floating debris. If floodwaters rise around your car, abandon it and move to safety if possible. Never drive into flooded areas, as both cars and motorcycles can be swept away. You can call the following 24-hour hotlines and download the must-have MySOMPO app to assist you during flood.

24-Hour Flood Loss Claims Hotline

Contact 1800-18-8010 to report for flood loss related claim (for Non-Motor Policies)

24-Hour Rakan Auto Assist Hotline

Contact 1800-18-8033 for car breakdown and towing services (Private and Commercial Vehicle)

24-Hour Motorcycle Auto Assist Hotline

Contact 1300-88-2323 for motorcycle breakdown and towing services

Frequently Asked Questions

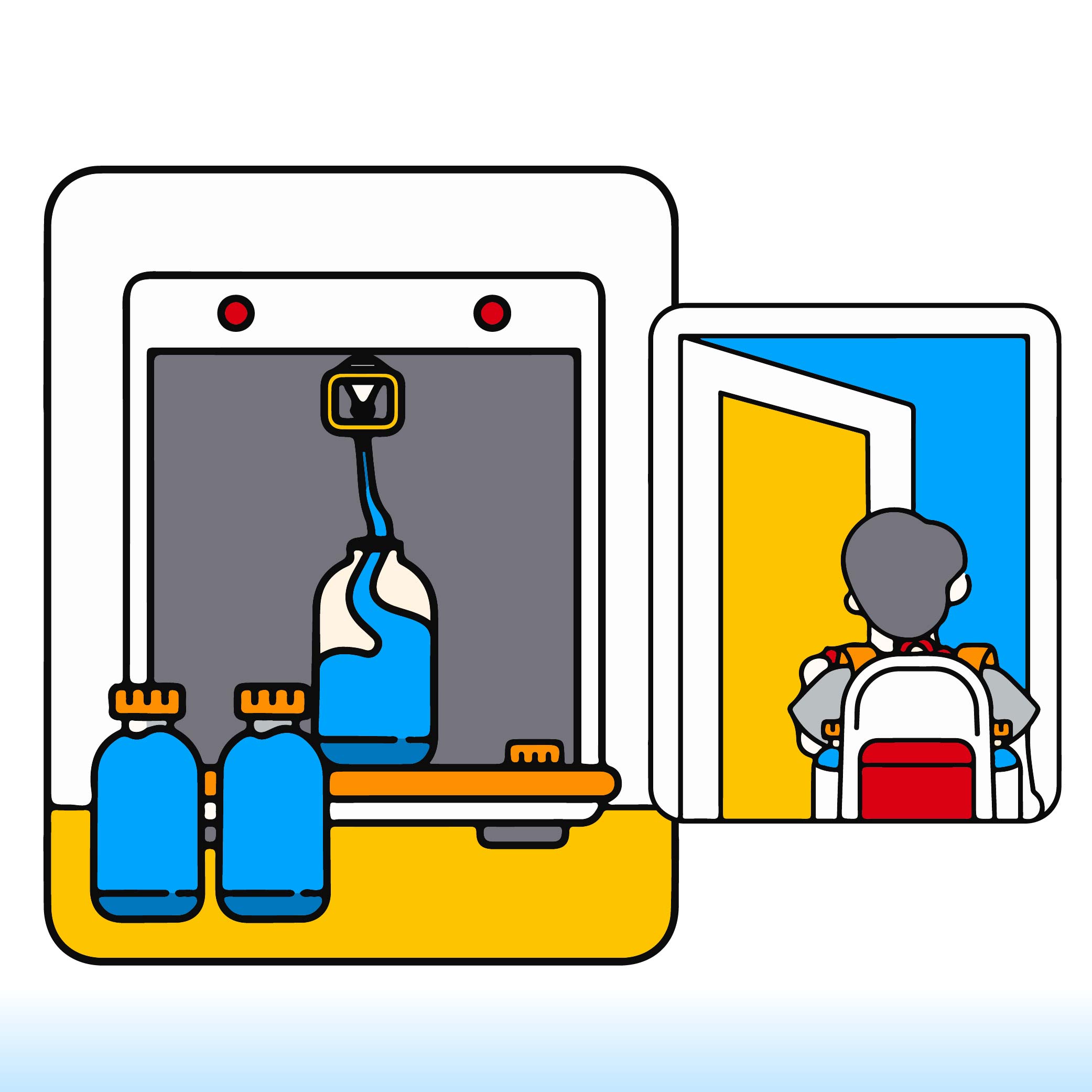

What should I do before a flash flood?

Before a flash flood occurs, it’s crucial to be prepared. Here's what you should do:

- Stay Informed:

- Monitor weather forecasts and flood alerts through reliable sources, such as local authorities or weather apps.

- Learn about flood-prone areas near you and identify your risk.

- Create an Emergency Plan:

- Know the safest routes to higher ground or evacuation centers.

- Plan how your family will communicate if separated.

- Prepare an Emergency Kit:

- Include essentials like bottled water, non-perishable food, a flashlight, batteries, a first aid kit, medications, important documents, and a phone charger.

- Secure Your Home:

- Clear drains and gutters to allow water to flow freely.

- Move valuables to higher places in your home.

- Turn off utilities like electricity and gas if a flood warning is issued.

- Stay Ready to Evacuate:

- Keep your vehicle fueled and park it on higher ground if possible.

- Avoid delays when evacuation orders are given—move to safety immediately.

For more practical advice on flood preparedness, explore our Essential Tips section below.

I am currently a policyholder of Berjaya Sompo Insurance and would like to make claims for my damaged home?

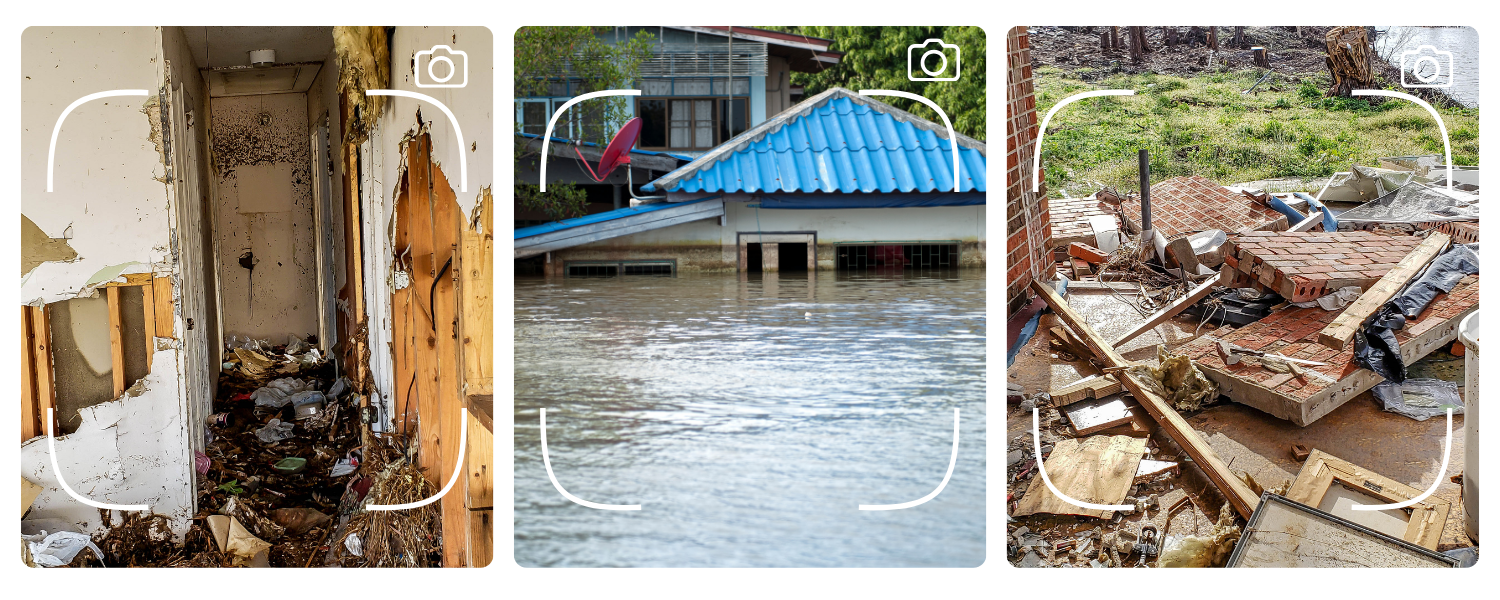

We know how overwhelming and difficult it can be to deal with the aftermath of a flood. Over the years, we’ve supported many customers in recovering from similar situations, and we’re here to help you too. If your home or belongings have been affected, please follow these 5 simple steps to get the support you need.

Step 1: Document the damage

- Take clear photos or videos of the damage including structural damage, household items and water levels.

(Photos and videos serve as visual evidence of the extent of the damage to your home and belongings. This is especially important if repairs or cleaning must be done quickly, as the evidence might not be visible later when the adjuster arrives).

- For damaged home contents, list the items along with their estimated values. Include receipts, warranty cards, or any proof of purchase (physical or electronic) to help determine their value.

- If you don’t have these documents or if they’ve been damaged, don’t worry, we’ve got you covered. We will carry out the assessment based on an estimate aligned with the current market value.

Step 2: Contact Us to report your claims as soon as you can

- If your home has been affected by flood, please call our Flood Loss Claims hotline at 1800-18-8010. We understand this is a challenging time, so to make the process easier for you, no claim form is required.

- When you call, simply provide the following information to Us:

- Your name

- Your policy number (If you do not have access to your policy number, you may quote us your NRIC or download the MySOMPO app to access your policy details)

- Your contact number

- This information is all we need to quickly appoint an adjuster who will assist you every step of the way. We're committed to helping you get back on your feet as smoothly as possible.

Step 3: Inspection visit by appointed adjuster

- Once we receive your call, we will assign an adjuster to visit your home to inspect and assess the damage within 24 hours.

- We understand that this is a challenging time, and we want to assure you that our adjusters are on standby in flood-affected areas. They will head to your location promptly after receiving your claim report. Before their visit, the adjuster will contact you to confirm your availability, ensuring the process is as smooth and convenient as possible.

(An adjuster is a professional we assign to help you during this difficult time by assessing the damage to your home after a flood or other insured event. Their role is essential in making the claims process smooth. They will carefully evaluate the damage and determine how much we can provide to support your repairs or replacements).

Step 4: Get updated with your claim's status

- If you have any questions about your claim, please feel free to reach out to our Customer Service team at 1800-88-9933 or get in touch with your dedicated agent.

- Alternatively, you can conveniently check your claim status here.

Step 5: Receive your payments within 24 hours

- For claims less than RM25,000, the adjuster will issue a Letter of Acceptance after their visit on the same day. Once you review and sign the offer, we'll ensure the payment is processed and issued to you within 24 hours upon receipt of the signed Letter of Acceptance. This is to help you recover as quickly as possible during this difficult time.

For claims more than RM25,000, we will provide a 20% interim payment of the approved amount within 24 hours of your acceptance. The remaining balance will be disbursed once we complete the full claims process, as additional time is needed for a more thorough assessment of the damage. Rest assured, we are working as quickly as possible to assist you.

(A Letter of Acceptance (LOA) is an official document that confirms our decision to approve your claim. It outlines the agreement to provide coverage for the damages or losses reported).

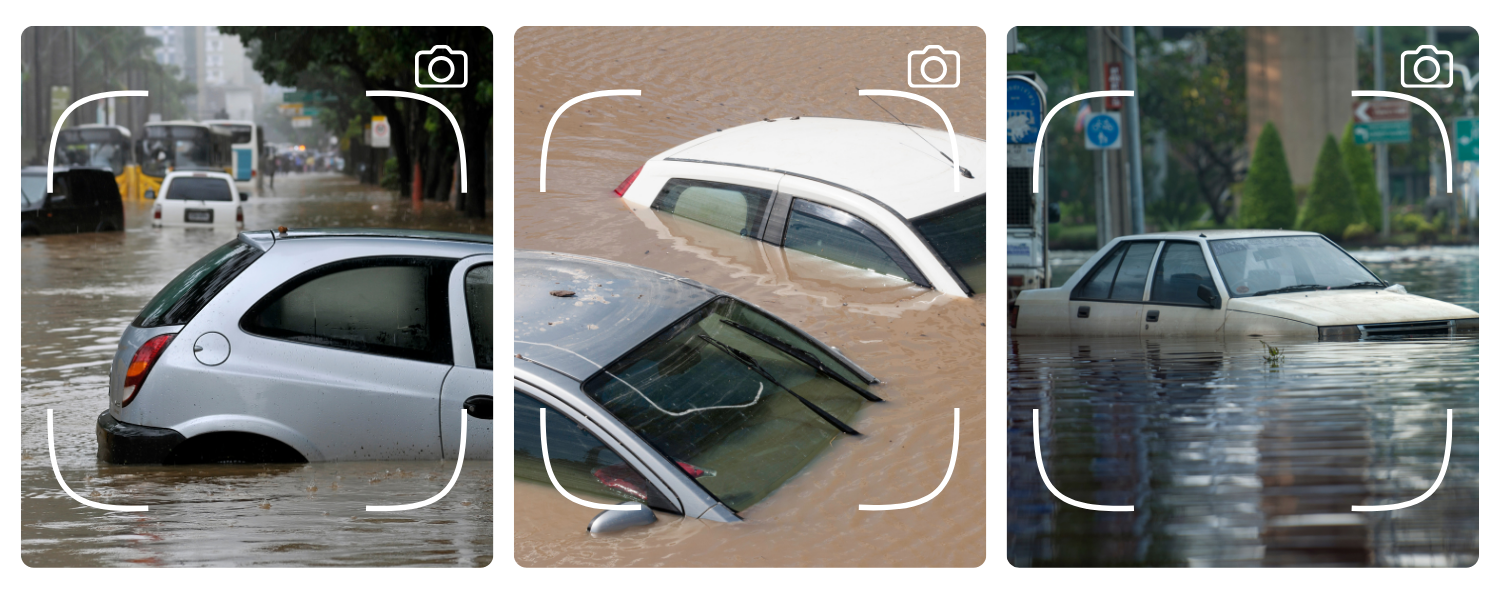

Help! My vehicles are affected by floods. What do I do and how do I submit my claims?

Take a deep breath. We understand how much your vehicle means to you, and we’re here to support you every step of the way. To make your claim process as smooth and stress-free as possible, just follow these simple steps to get started.

Step 1: Ensure Safety First & Take Pictures/Videos of the Damages

If you find yourself trapped in your car with rapidly rising water, stay calm and get out immediately if it’s safe to do so. Head to higher ground as quickly as possible. Your safety is the most important thing. If the situation allows, here’s what you can do to help us assist you better:

- Protect your vehicle from further damage: For your safety and to prevent additional harm, please do not start your car or motorcycle if it has been submerged in water.

- Document the situation: Take clear photos or videos of the damage to your vehicle and the surrounding area. These will be extremely helpful for your claims process and will allow us to make things smoother and faster for you.

Step 2: Immediately Contact Us

We know how stressful it is when your car is affected by a flood, and your safety comes first. Please call us immediately so we can assist you right away. You can reach our 24-hour Rakan Auto Assist at 1800-18-8033 for towing services or use the MySOMPO app to request towing to our approved workshop quickly and easily.

If you have an agent, feel free to contact them after calling us. They’re always ready to help with follow-ups or extra support. But remember, calling us first is the most important step so we can start helping you immediately and make your claim process as smooth as possible.

Step 3: Notify Us & Submit Required Documents

We understand how stressful it can be when a flood damages your car, and we’re here to make things easier for you. To ensure we can respond to your claim immediately, we’ve waived the need for a police report. Here’s what you’ll need to provide to get started:

- Complete the claim form. You can do this easily here or through our e-Claim platform, accessible via our corporate website or the MySOMPO app.

- Attach the following documents:

- Your IC, Vehicle Ownership Certificate (Grant) and driving license.

- Clear photos of the scene and your flood-damaged vehicle.

- If your policy includes extra benefits like a Flood Relief Allowance, submit your vehicle cleaning invoice along with before-and-after photos of your vehicle to claim your reimbursement.

Once you have all the documents ready, you can submit them through these convenient channels:

- Online: Via our website or the MySOMPO app for a quick and seamless process.

- Through Your Agent: They’re here to help and guide you through the process.

- Through Our Approved Workshops: If your vehicle is towed for repairs, the workshop will assist with the claims processing.

Step 4: Appointed Adjusters will Inspect and Assess your Damaged Vehicle

- Once we receive a complete claims document, an adjuster will be appointed within 24 hours to inspect and assess the damages of your vehicles.

- We understand this can be a challenging time. That’s why we’ll arrange for a professional adjuster to evaluate your car or motorcycle’s damage and work closely with our approved workshop to carry out the necessary repairs as quickly as possible.

(An adjuster is a trained insurance professional responsible for assessing and evaluating the damage to a vehicle after an accident, flood, or other incidents. Their primary role is to inspect the damage, determine the extent of repairs needed, and estimate the cost of those repairs to ensure the claim is processed accurately and fairly).

Step 5: Claims Approval

- Once we receive all the necessary documents, including the adjuster’s report, we’ll approve your claim within 5 working days. The repair costs will be paid directly to the workshop to get your vehicle back on the road as soon as possible.

- If your policy includes extra benefits like a flood relief allowance, we’ll make sure to reimburse the amount directly to you.

Step 6: Get updated with your claim's status

- If you have any questions about your claim, please feel free to reach out to our Customer Support team at 1800-88-9933 or get in touch with your dedicated Agent.

- Alternatively, you can easily track your claim’s status via the MySOMPO App or website.

Step 7: Collecting Your Car

- We will let you know once your car has been completely repaired and ready for collection. Upon collecting the vehicle, you will need to sign a discharge voucher to effect payment to the workshop.

(A discharge voucher is a document you sign to confirm that the repairs or services to your vehicle have been completed to your satisfaction and authorise payment to the workshop).

I am unsure whether my product covers damages from flood, how can I check?

Each product comes with its own unique benefits, including flood-related coverage. However, some products may require an add-on for you to enjoy this benefit. We encourage policyholders to consult their agent or refer to their policy contract for detailed information. Alternatively, you can explore the Check If You Are Covered section below to learn more about our products that offer flood-related benefits.

I am worried that my vehicle / home will be flooded again. What kind of products do you offer to protect against potential financial losses?

We offer a comprehensive range of flood-related benefits for homes and vehicles, as well as health and personal accident products. These benefits include coverage for flood-related illnesses such as dengue and malaria, as well as accidents arising from flood-related incidents. For more details, please refer to the Check If You Are Covered section below.

Check If You Are Covered

Unsure whether your policy with us covers damages from the flood? The following products and coverage/benefits add-ons listed below would cover damages caused by the flood.

For further information, please reach out to your friendly agents.

For other inquiries or assistance, please contact our Customer Service at 1-800-88-9933, 8.30 a.m. - 5.00 p.m. (Monday to Friday), email us at customer@bsompo.com.my, or chat with us via Facebook message @berjayasompoinsurance.

Personal Insurance

Protection for Home

| SOMPO Home Content |

| Covers your home contents (household goods and personal effects) against loss or damage by all risks, including flood, with no penalty on underinsurance. Policyholders do not need to submit receipts of items when submitting claims about damages caused by the flood. |

| SOMPO HomeNOW |

| Covers your home contents (household goods and personal effects) against loss or damage by all risks, including flood. Policyholders do not need to submit receipts of items when submitting claims about damages caused by the flood. There’s a limit for individual items. |

| Houseowner / Householder / Home Care |

| Covers loss or damage to your building or contents by flood, but exclude loss or damage caused by subsidence or landslip, except as a result of an earthquake or volcanic eruption. |

Note: There may be other products available for purchase. Please speak to our Customer Service for more information.

Protection for Car

| SOMPO Motor / SOMPO MotorSafe |

| Special Perils Coverage is included in the Basic Policy, covering up to the sum insured for loss or damage to your vehicle caused by floods, typhoons, storms, and other natural disasters. This gives policyholders full protection against these events. |

| Private Car |

| Inclusion of Special Perils (only applicable to Comprehensive Cover) with additional premium available for customers to choose from. |

Protection for Motorcycle

| SOMPO Motorcycle, Motorcycle Insurance (Comprehensive Cover) |

| Opt for Special Perils Add-On full coverage from as low as RM10, including flood. |

Hospitalisation due to Accidents/Illnesses

| SOMPO Health |

| Covers hospitalisation & surgical expenses due to flood accidents and illnesses (e.g. Malaria, Diarrhea, Typhoid, Dengue, Appendicitis, etc.) with renewal up to 100 years old. |

| Ultima Care |

| A 24-hour worldwide protection that covers Accidental Death or Accidental Permanent Disablement should an unfortunate event (e.g. flood) causes death, injury, or permanent disability. With an additional premium, policyholders can be covered for treatment due to an accident. |

| Ultima V3 |

| Covers Accidental Death or Accidental Permanent Disablement on top of other benefits, which include but are not limited to all natural disasters, exposure to the elements as a result of an accident, and insect & animal bites that cause immediate injury. |

| SOMPO Premier PA |

| A premium personal accident insurance plan provides coverage of up to RM3.5 million for accidental death, permanent disablement, or other losses caused by natural disasters. It also offers bereavement benefits of up to RM20,000 for deaths caused by Dengue, Malaria, Japanese Encephalitis, Zika, and Chikungunya. These diseases often increase during floods due to stagnant water and poor sanitation that create ideal conditions for mosquito breeding. |

Bancassurance Products (Distributed and sold by CIMB Bank)

Protection for Home

| Home Safe Plus |

| Provides comprehensive protection for your building(s), home contents and personal effects. |

| Secure Home |

| Insurance plan that covers household goods and personal belongings against loss or damage by all risks, including fire, lightning, flood, theft, accident and more. |

| Houseowner / Householder |

| This policy provides coverage for your building against loss or damage by fire, lightning, explosion, flood, burst pipe or any perils mentioned in the insurance policy. |

Protection for Car

| Secure Motor |

| Secure Motor is a Private Car Comprehensive Insurance policy, which offers better coverage to meet your needs on the road. Special Perils Coverage included without additional premium – claim amount up to 10,000 or 20% of the Sum Insured, whichever is lower for any loss or damage to your vehicle caused by flood, typhoon, hurricane, storm, tempest or other convulsions of nature. With an additional premium, policyholders can be covered for the full convulsion of nature. |

Customer Service Charter

At Berjaya Sompo Insurance Berhad, our mission is to make insurance easy for you. We are dedicated to creating a positive customer experience through accessible information, clear product features, convenient payment methods, and a hassle-free claims process. These principles serve as the foundation of our Customer Service Charter at Berjaya Sompo Insurance. Find out more about our Customer Service Charter here.